How prepared are Swiss companies for the upcoming new regulations on climate reporting? Should companies expect any changes to the current regulatory framework? What are some practical tips is navigating the climate assessment and reporting process? These are some of the questions that were explored at the event Climate Reporting in Switzerland - Ready for 2025?

Organised by Pelt8 in collaboration with GreenBuzz Zurich, Enfinit and hosted by SIX, the event was well attended by almost 200 participants from companies listed on SIX Swiss Exchange, sustainability consultants, private companies, growth startups, and non-profit organisations. Christian Reuss, Head SIX Swiss Exchange, delivered the opening remarks and emphasized the Exchange’s perspective on the importance of transparency. He provided an overview of initiatives designed to offer guidance on sustainability to the issuers listed on the Swiss stock exchange, while Vera Sokulskyj, Head Issuer Relations, emphasized how the exchange can help issuers in their journey to meet TCFD requirements such as the Sustainability Handbook or collaborative initiatives with universities as well as supporting such events.

Photo Credits: Carmen Sirboiu

Swiss listed companies are not yet aligned with TCFD Recommended Disclosures

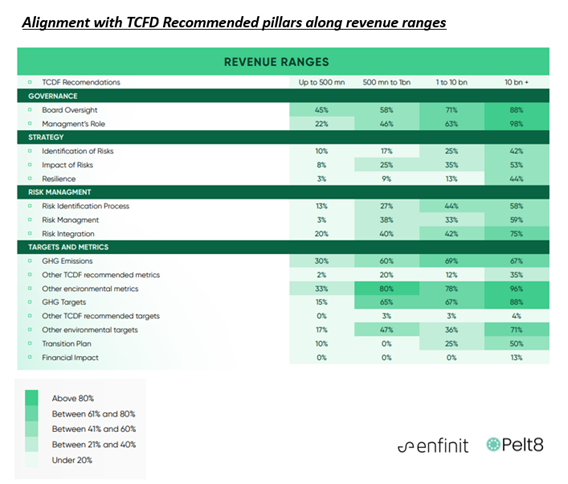

To get a better understanding of how aligned are Swiss companies with the upcoming regulations, Qendresa Rugova presented the results of a recent Thought Leadership Report conducted by Enfinit (a Geneva-based advisory practice specializing in the energy transition) in collaboration with Pelt8 (a Zurich-based technology company offering digital solutions for sustainability reporting). The Study analysed the climate reporting landscape of 40 companies listed on the Swiss stock exchange and assessed their readiness for climate reporting before the mandatory disclosures take effect. In summary, the study concluded that climate reporting by Swiss companies is not yet aligned with the disclosure requirements. Out of the four categories assessed (Governance, Strategy, Risk Management, and Metrics & Targets), Governance is the best aligned with two-thirds of companies already disclosing information. The most notable misalignment is observed in the area of Strategy where on average less than 20% of assessed companies report clearly on the potential impact of climate-related risks on their company strategy. One important take away is also the lack of attention to Double Materiality, a requirement highlighted in the Ordinance. While companies disclose information related to impact materiality (company`s impact on the environment), data reveals a significant misalignment concerning Financial Materiality (the potential impact of climate related risks on company performance). Lastly, a positive correlation is observed between turnover ranges and disclosure readiness, depicted in the figure below.

--> Download the Thought Leadership Report here

Companies should focus on concrete Transition Plans and less on minimum compliance

The event also explored key areas pertaining to policy and regulatory framework. Christoph Baumann (Envoy of the State Secretary for Sustainable Finance - State Secretariat for International Finance (SIF)), emphasized the fact that regulations are here to stay, and reporting requirements may be expanded to include more companies that fall within the obligatory reporting. Furthermore, he emphasised that the focus should be on increasing transparency and devising concrete transition plans as well as monitoring progress and less on mere compliance. Reporting standards will likely converge in order to increase the efficiency of the reporting process and CSRD serves as a comprehensive framework. Companies are free to choose the reporting framework so long as they appropriately address Double Materiality, which is an obligatory requirement.

Photo Credits: Carmen Sirboiu

The discussion was followed up by presentations from Antonio Carrillo (VP Sustainability at Holcim), Adrian Kyburz, PhD (Director of PMO & Engagement, Sustainability at Novartis) and Rob Wyse (Head of Climate & Nature Manager at Zurich Insurance), who shared their journeys on implementing climate reporting within their respective companies, highlighting specific challenges and tips on overcoming such hurdles. Some of the key takeaways are:

- From Project to Process - Embedding sustainability within the Company

Climate-related assessment cannot be done in isolation. A strong buy-in from the leadership is of outmost importance. There is a need to transition from "project-to-process" whereby sustainability strategies are integrated at all levels of the organization and are not stand-alone projects. In addition, there is a need for strong ownership from Finance departments to ensure that risks are well understood and appropriately quantified. Last, but not least, stakeholders need to be included in the process to ensure that they have a say in the strategy formulation and development process. - You cannot manage what you cannot measure – use data to shape strategy

Risks should be analysed, understood and quantified. Only by analysing the data will one be able to understand trends, build scenarios, which can then be shared with the executive team. This information can then be used to shape a resilient strategy.

Businesses operating with limited financial resources and small to medium enterprises (SMEs) must discover effective strategies for integrating new data management, auditing, and reporting procedures while navigating the complexities of reporting standards. It's imperative to maintain high standards without sacrificing quality, emphasizing collaboration with stakeholders across the value chain to transform this challenge into an opportunity. - Climate-risk assessment requires long-term thinking

Scenario analysis requires companies to think beyond their typical corporate planning, which may sometimes be counter intuitive. This calls for a shift in perspective to enable stakeholders within a company to think beyond the typical timeframes. Furthermore, different methodologies may be required for different business units. As such, a pragmatic and sustainable approach, reflective of resource availability and insight, is required. - Join relevant networks and share experiences

It is important to build relationships with sustainability professionals and experts for practical application. Invest in continuous training: identify internal talent, expand sustainability-related skills, and introduce new key figures. - Disclosures should be visual and impactful

Disclosures should include impactful visuals that enable readers to get a better understanding of key messages.

The event provided tangible examples on how to implement some of the more challenging aspects of climate reporting and demonstrated the benefits of such gatherings where experiences and lessons can be shared. SIX will continue to support such endeavours with the annual Climate Reporting event planned on the 17th of May – more information available here.

Contact

Qendresa Rugova

Managing Director @Enfinit

qrugova@enfinit.ch

Gwen Jettain

Chief Commercial Officer @Pelt8

gwen.jettain@pelt8.com