AGM Season 2020: What we observed

The Swiss AGM Season 2020 will be remembered for the particular circumstances of the Covid-19 pandemic. This crisis muted public attention and diverted the focus of institutional investors to a large extent. The key takeaways of this season can be summarized as follows:

- Shareholder participation in AGM votes increased slightly compared to 2019, despite the Corona-lockdown, indicating a strong determination by shareholders to exercise their voting rights

- Shareholder origin matters in terms of topics of concern as well as in terms of the overall level of criticism: In general, continental European institutional investors vote against a much higher number of agenda items than their US peers

- Proxy advisors’ overall impact on AGM voting outcomes has come down from previous years, but their influence on the voting behavior of minority shareholders’ (shareholders owning less than 10% of a company) remains substantial

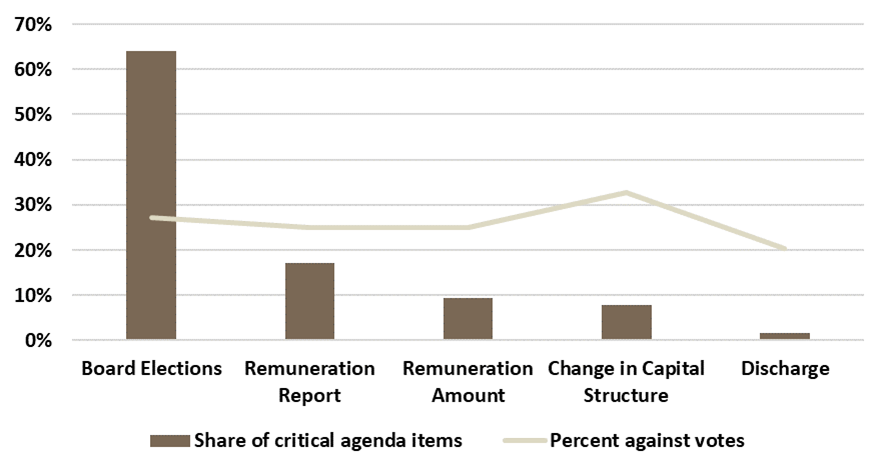

- Board elections are increasingly in the focus of shareholders and proxy advisors, making up almost 2/3 of the most critical agenda items in the AGM Season 2020 (defined as items with more than 20% AGAINST votes). This is a considerable increase from 56% in 2019.

- Amongst board elections, compensation committee appointments were the most critical ones: proxy advisors recommended voting against every fifth candidate on average. Other topics under growing scrutiny by shareholders and proxy advisors are director independence, overboarding, and accountability with regard to sustainability and nomination issues.

Figure 1: The most critical AGM items (more than 20% AGAINST votes) of the AGM season 2020 by topic. Sample: 100 larget SPI® companies with their AGM between July 2019 and June 2020. Source: SWIPRA AGM Season Review 2020.

AGM Season 2021: What we expect

While the AGMs 2020 were rather quiet due to the Covid-19 situation, the crisis acted as a catalyst raising key issues related to corporate governance and corporate social responsibility (CSR) to broader attention. Consequently, we expect an AGM season 2021 that will be much more aggravated, with the key focus of shareholders and proxy advisors on decisions taken by the board of directors in a time of crisis:

- Compensation: How is the impact of Covid-19 reflected in the compensation decisions? There is consensus amongst institutional investors that the burden of this crisis should be shared, in particular between management and employees. They also expect to see CSR better reflected in incentive schemes in general.

- Payout/Capital allocation: How does Covid-19 impact the payout decisions for 2020 and what capital allocation strategy can shareholders expect going forward? The topic of sustainable payout levels has already been raised in previous years but now has become a key item of interest, not only in terms of dividend levels but more broadly in terms of capital allocation in general. This triggers the discussion of long-term strategic interests versus short-term oriented dividend optimization and the challenge to address the interests of the various investment schemes of institutional shareholders.

- Corporate Social Responsibility I: How is the board of directors thinking about CSR and to what extent are CSR, incentives, and strategic goals aligned and consistent with the company’s view on how to create long-term sustainable value? CSR is and can no longer be seen as a philanthropic topic while ignoring its relevance for long-term value-creation and its integration with corporate strategy.

- Corporate Social Responsibility II: Does the board have the right skills and actively demonstrates its understanding of how corporate culture, incentives, and CSR risks and opportunities more broadly support the achievement of strategic goals? The wide-ranging impact of CSR integration into corporate strategy makes it necessary for the board to become the process owner in this discussion.

- Reporting/Engagements: The complexity and the importance of non-financial matters for long-term value creation require a more intense dialogue between companies and their stakeholders. Board and committee chairs are expected to spend more time engaging with their stakeholders, explaining the individual situation of the company and the decisions taken in this regard.

This is only an outline of the wide array of questions that companies will face going into the 2021 AGM season. On top of that, the implementation of the revised Swiss corporate law will have to be prepared and potential spillover effects from EU regulations on shareholder rights and CSR disclosure will have to be followed closely.

For companies and in particular, their boards of directors, providing answers to the above questions that are in alignment with their internal values and acceptable to their key stakeholders will require a well-balanced and thoughtful weighing of the inside-out and the outside-in perspective and continuous dialogue.

| Andrea Bischof is Managing Director of Morrow Sodali. She has more than 20 years of experience in communications and spent the past 13 years at D.F.King, where she advised listed companies including the largest Germanic corporates in several hundred AGM campaigns, proxy contests and M&A situations. During the course of her career she has helped her listed clients to understand and effectively engage and communicate with their shareholders. | |

| Barbara Heller is Managing Partner at SWIPRA Services Ltd. She has many years of experience in corporate finance, capital markets and corporate governance advisory from various assignments in international investment banking, and as executive and board member. During her career, Barbara worked with her corporate clients and their stakeholders to execute strategic key initiatives and projects including IPO’s, M&A and change management projects. Currently she is also a Member of the board of directors and chairwoman of the Audit Committee of Bank Cler Ltd, Vice-Chairwoman of the Swiss CFO Forum, Chairperson of the Jury of the Swiss CFO Award and Of Counsel at Lemongrass Communications Ltd. She is also active on boards of sport and non-profit organizations and holds an MBA in economics and finance from the University of Zurich. | |

| Christoph Wenk Bernasconi is Partner at SWIPRA Services Ltd. He is a founding member of SWIPRA and responsible for the scientific approach of its projects and analyses. He is co-author of the SWIPRA Considerations for Corporate Governance and of the SFI Whitepaper on corporate governance. Further, Christoph is a Senior Researcher at the Department of Banking and Finance at the University of Zurich. |